How to Trade Indices: All You Need to Know About Trading Indices

Index trading can be best described as the buying and selling of a specific stock market index. By trading stock indices, traders can speculate on the price of a certain sector, market, or an entire economy. This allows traders to gain broad market exposure, diversify risk, and capitalize on the overall performance of a group of leading companies rather than relying on individual stocks.

So, if you want to start trading indices, you need to learn about trading indices and how they work. You also need to be aware of all the methods by which you can get access to index trading. In this guide, we explain what indices CFDs are, list the main factors that impact stock indices market prices, and provide tips to start trading global stock indices.

What Are Indices in Trading?

Indices are normally the most widely covered assets in financial markets. Even those who don’t actively trade or follow financial markets are likely familiar with stock indices. You often hear them mentioned in the news or in casual conversations with friends and colleagues. That’s because stock indices serve as one of the clearest benchmarks for measuring the economic performance of a country, region, or sector.

Essentially, stock indices were designed to measure the performance of a certain stock market by creating a basket of the best-performing individual stocks in an exchange and tracking their performance.

For example, the S&P 500 is an index that tracks the performance of the largest 500 companies listed on all US stock exchanges. The US dollar index measures the value of the US dollar versus a basket of the world's most traded currencies. The EU Stoxx 50 is an index that measures the performance of the 50 largest companies by market capitalization.

Different Types of Indices

Generally, there are different types that include:

Global Stock Market Indices - Global stock market indices consist of shares from companies around the world. A prime example is the Dow Jones Global Titans 50, which tracks 50 of the largest and most actively traded stocks listed on major exchanges such as the NYSE, ASE, Nasdaq, Euronext, London Stock Exchange (LSE), Frankfurt Stock Exchange, and the Tokyo Stock Exchange. Other examples include the Dow Jones 30, NASDAQ100, S&P500, Russell 200, DAX40, FTSE100, and many more.

Regional Indices - Regional indices track stocks from a particular geographic area, such as South America, Europe, or Asia. A well-known example is the Euro STOXX 50, which represents the performance of 50 leading companies from 11 Eurozone countries.

Sector Indices - These indices measure the performance of a group of stocks within a particular industry or sector. Some of the key sectors include Energy, Technology, Financials, Industrials, Real Estate, and Healthcare.

Commodity Indices - A commodity index typically represents a fixed-weight basket of selected commodity prices, based on either spot or futures prices. These indices are designed to reflect the performance of a broad commodity category, such as energy, grains, livestock, or metals. They may track the commodities themselves or do so indirectly by following related futures contracts.

Bond Indices - These indices reflect the total return generated by a portfolio of bonds, incorporating factors like price fluctuations, accrued interest, and reinvested coupon payments. Bond indices can cover various categories, including government bonds, high-yield bonds, corporate bonds, and mortgage-backed securities.

Indices Trading - How Does Trading Indices Work?

Global indices cannot be traded directly since they are not purely securities. Because indices are simply a collection of stocks or other assets, they are traded through derivatives like futures, Contracts for Difference (CFDs), and ETFs, which allow traders to speculate on index price movements without actually owning the underlying stocks.

Each method has its own merits and is suited for different types of traders. However, because indices are simply benchmarks and there’s no purpose for trading different contracts (such as expiration dates, sizes, etc.), the majority of traders look to trade cash indices that trade at the spot price. For that reason, trading index CFDs has become an extremely popular method to get exposure to these financial instruments.

With CFD trading, investors can trade stock indices with leverage and with a fairly low initial investment.

Yet, you need to remember that regardless of the method you choose to trade indices, the process of trading indices is similar to trading any other financial instrument. Investors simply speculate on the price market movement of the index by analyzing the economic health of an economy or a certain market. You buy the index when you predict that its value might rise, and short-sell when you speculate that its value is likely to fall.

How Are Stock Market Indices Calculated?

Stock market indices are calculated in different ways - by market capitalisation, price, or a method of equal calculation. The vast majority of stock indices are calculated and weighted according to the market capitalization of the index’s companies. With this method, large-cap companies have a greater impact on the index performance. For example, the S&P 500 is a market capitalization-weighted index of 505 of the largest companies listed in the US. Apple Corporation has a weighted average of 5.47%, which clearly makes it a dominant stock in the index, and as such, its performance will have a larger impact on the S&P 500 performance than small-cap companies like Amcor (0.04).

You can visit this page to view the S&P 500 stock components.

What are the Most Popular and Traded Indices in the World?

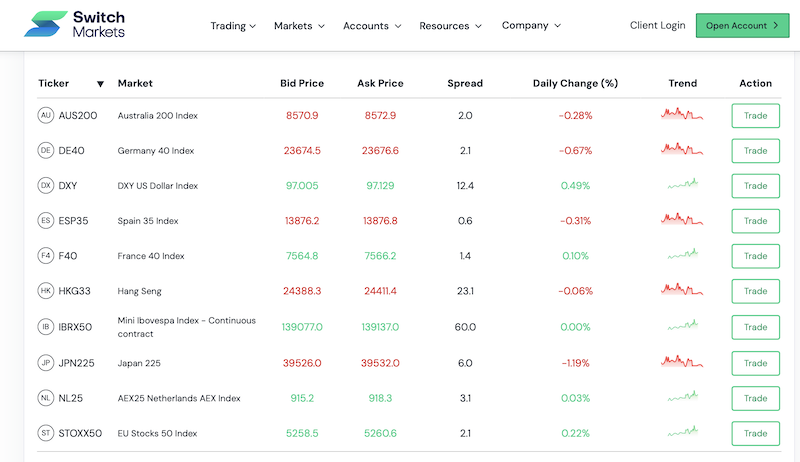

Below, you can find a table of the most traded stock indices in the world as of 2025.

*Other popular stock market indices include the FTSE China A50 Index, the US Dollar Index, Ibex 35 (Spain), EuroStoxx50, Hang Seng Index, S&P/NZX 20 (New Zealand), Shanghai SE Composite, etc.

Trading Indices vs Forex

Most new traders who enter the trading scene often ask which asset class is better to start with—stock indices or forex. For various reasons, most people go straight to trading forex since this is considered the best market for beginners. This can be attributed to the fact that the forex market is easier to understand. Additionally, the forex market is the most liquid market, which is exactly what new traders need.

However, many might agree that both markets work quite similarly. Also, there’s no reason for a trader not to take advantage and trade both markets, especially when there’s a high correlation between the forex and stock markets.

Still, there are key differences between trading indices and forex:.

Leverage Ratio

First, in terms of the leverage ratio provided by brokers, you’ll be able to get higher leverage when trading forex. For example, Switch Markets provides a leverage ratio of up to 500:1 for forex trading and 200:1 for indices trading. Yet, you must remember that high leverage is not necessarily a good thing, particularly for swing and long-term traders.

Liquidity

Beginner traders need a liquid market so they will not get stuck in a liquidity trap where there’s a market with no buyers and sellers. When we compare indices vs forex, then the forex market certainly has higher liquidity. Having said that, when trading CFDs, liquidity is not a factor as the broker ensures you get market execution at any price. Therefore, trading CFDs on indices is perhaps the best option for a trader to buy and sell indices.

Market Dynamics

Both Forex and indices trading are heavily influenced by global economic trends, interest rate shifts, and geopolitical events, making them highly volatile and often unpredictable. That means that when traders use fundamental analysis to analyse FX currency pairs or stock indices, the key factors to look at are quite similar. However, index trading is shaped by the performance of the companies within the index and wider economic indicators, generally providing a more complex trading environment. For that matter, when trading indices, you must also follow stock fundamental analysis, which includes individual stock price performance, dividends, and seasonality.

Volatility

Finally, market volatility. It is difficult to find a decisive answer to this argument. Some say the forex market is more volatile than the stock market, and some say the opposite. Nonetheless, both currency pairs and stock indices are great assets for intraday and long-term trading, so there’s no reason to focus on only one market.

Factors that Affect Stock Market Indices

When trading stock indices, there are some factors affecting the stock market that you need to consider:

- Macroeconomic news and data: News and economic data have an impact on market sentiment and normally cause changes in index prices. These include central banks' announcements, economic data (GDP, CPI, Non-Farm Payrolls, etc), economic outlook, analysts’ forecasts, etc.

- Changes in stock index composition: Most index providers often rebalance their indexes by removing and adding companies. In this case, investors respond to such information, and the index is affected by the change in composition (usually, the index will be positively affected by the change in the index composition).

- Companies’ earnings results: Public traded companies are required to release their earnings reports four times a year, a phenomenon known as the earnings season. During this time, the stock market is extremely volatile, and the reports of individual companies have a direct impact on index price movements.

- Economic and political events: Factors like political instability, war conflicts, elections, and budget disputes can significantly affect economic growth and stock prices.

- Inflation and interest rates: There’s a negative correlation between inflation and stock prices. When inflation rises above the target range (typically between 1-3), central banks are forced to increase interest rates, which negatively affect stock prices and stock market indices.

How to Trade Indices

As mentioned above, traders have several options for trading indices. One effective way to do so is through contract for difference (CFDs), which allows traders to trade with leverage and gain access to a top-notch trading platform. To start trading index CFDs, you simply need to follow the next steps.

- Open an online trading account with Switch Markets.

- Fund your trading account with one of our funding methods.

- Select the index you want to trade on and follow market news and economic data that has an impact on the chosen index.

- Buy or short-sell the index.

- Use risk management tools such as a stop-loss order and a risk-reward ratio.

Final Word

To sum up, trading indices is certainly a great way to get exposure to stock markets. It is probably not the easiest market to trade due to the complexity of stock markets; however, following and trading stock indices will help you find lots of trading opportunities. Additionally, there are many benefits to trading indices. It’s fairly easy to get information from news websites about a certain index; you can trade indices with leverage, and you have the ability to take long and short positions.

To get started, you need to decide on the way you want to get access to index trading. This could be done either with a share trading brokerage firm or a CFD broker. If you are a beginner, you can open a free demo account to get access to the markets and practice index trading with virtual money.

FAQs

Here are some common questions about index trading:

Is it possible to invest directly in a stock index?

In essence, you cannot buy an index directly from the exchange. An index is not a security but an indicator that tracks the performance of a certain market. However, there’s a way to do that by buying the exact companies listed in an index, a strategy called indexing. This could normally be done on indices that track a small number of stocks rather than indices like the S&P 500 or Nikkei 225.

How to trade the world's major indices on MT4/5?

To trade major indices on MetaTrader 4 and 5, you obviously need to find an online brokerage firm that gives users access to this platform. Here, at SwitchMarkets, we offer traders the ability to trade a wide range of stock indices with a leverage ratio of 200:1 on MT4/5. Additionally, on the Switch Markets platform, traders can trade the VIX index and the US dollar index.

Which stock index is the most volatile?

In the US, two of the most volatile stock market indices are the NASDAQ 100 and the Russell 2000 index. In Europe, the DAX30 is known as one of the most volatile indices in the world.

What are index futures?

Stock index futures are derivative contracts that trade on various futures exchanges such as the Chicago Mercantile Exchange. These futures are cash-settled and allow investors to speculate on the price movement of different indices.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.