How to Trade the VIX Index

Imagine you can trade the fear in financial markets, the concerns of investors, and speculate on the market sentiment. Quite a bizarre concept, but this is what the VIX index is all about. It’s an index that allows you to speculate on the mood in the markets. And, in some market scenarios, especially when there’s panic in the markets, it is the go-to asset for many investors and traders.

This guide will show you how to trade the VIX index using futures, options, and ETFs. You’ll learn practical strategies, essential tools, and risk management techniques to navigate the complexities of VIX trading.

Key Takeaways

What is the VIX Index?

The VIX Index, often called the ‘Fear Index’, is the first benchmark index measure of market expectations for near-term volatility, derived from S&P 500 options. Created by the Chicago Board Options Exchange (CBOE) in 1993, the CBOE volatility index VIX provides a 30-day forward projection of equity market volatility based on the prices of SPX index options nearing expiration. Essentially, this index reflects the market’s expectations for volatility over the next month, serving as a critical gauge of investor sentiment and market risk.

Calculated in real-time during market hours of the CBOE options market, the VIX typically rises when stock prices fall, signaling increased fear and uncertainty among investors. On the other hand, when things are stable and stock markets rise, the VIX’s value is likely to fall. Normally, when the VIX index value is above 30, it can often be associated with high market volatility and investor fear, while values below 20 indicate relative stability.

Understanding the VIX Index helps traders anticipate market movements and make informed investment decisions. Additionally, many traders use the VIX as a trading instrument on its own, trying to speculate on its value to make profits.

The VIX typically rises when stock prices fall, signaling increased fear and uncertainty among investors. On the other hand, when the markets are stable, the VIX’s value is likely to fall or stay at the same levels.

How the VIX Index Works

Comprehending the VIX Index requires an understanding of its calculation methodology. The VIX is derived from the weighted prices of S&P 500 index options, both puts and calls, with near-term expiration dates. By aggregating these option prices, the VIX estimates the expected volatility over the next 30 days. This forward-looking nature makes the VIX a valuable tool for predicting how the VIX index is calculated and can indicate market fluctuations.

Higher VIX values indicate greater expected market volatility and increased uncertainty, often leading to higher option premiums as demand for options increases. Conversely, lower VIX values suggest a calmer market with less anticipated price movement and low volatility. Understanding these dynamics allows traders to gauge market sentiment and adjust their strategies accordingly.

What Drives the Value of VIX

The VIX is a forward-looking index derived from S&P 500 options prices. In essence, it reflects the market’s consensus on future 30-day volatility for the S&P 500. Several factors determine its value:

Options Demand

Because the VIX is calculated from prices of near-term S&P 500 index options, changes in demand for those options move the VIX. In particular, when investors aggressively buy index puts (for portfolio insurance) or sell calls in a falling market, implied volatility rises. This pushes the VIX up. In times of panic or hedging (e.g., during a sell-off), heavy put buying “drastically” outpaces supply and drives up option premiums and the VIX.

Conversely, when few traders seek protection and option buying is light, implied vol falls and the VIX declines. It is, therefore, advisable to follow SPX options to evaluate the VIX's future value.

Market Sentiment/Fear

The VIX is often dubbed Wall Street’s “fear gauge” because it rises when investors are anxious and falls when optimism prevails.

A sharp drop in stock prices or a negative news shock typically lifts the VIX, as traders rush to hedge or speculate on volatility. For example, the April 2025 tariff announcements spooked markets and drove a surge in the VIX.

In contrast, bullish sentiment or good news (like strong economic data) usually suppresses the VIX, as was seen when U.S. jobs gains in June 2025 helped push the VIX lower.

Implied Volatility Expectations

By definition, the VIX is an implied-volatility measure. It incorporates expected volatility embedded in options prices. If traders forecast a volatile month ahead (even before it happens), they bid up option prices today, raising implied volatility. Thus, the VIX can jump on rumors or anticipation of volatility.

Importantly, implied volatility tends to mean-revert over time: extreme spikes are often followed by declines as perceived risk eases. The typical shape of the volatility curve reflects this: VIX futures are usually in contango (longer-dated futures higher than spot) because markets generally price in higher volatility out on the curve, anticipating eventual mean reversion.

Macroeconomic and Geopolitical Uncertainty

Major economic events or geopolitical crises drive volatility expectations. Elections, central bank decisions, fiscal policy changes, wars, pandemics, etc., can all push the VIX up.

For instance, the Fed’s shift toward tighter policy in 2022 and the war in Ukraine added to volatility, helping keep VIX elevated that year. Similarly, unexpected shocks (COVID in 2020, banking turmoil in 2023, trade wars in 2025) have caused sharp VIX spikes.

When uncertainty or instability is high, more traders seek protection, which raises implied volatility and, thus, the VIX's value.

VIX Term Structure

The VIX itself isn’t directly tradable, so traders use futures and ETFs that depend on the VIX term structure. Under normal conditions (~80% of the time since 2010) the futures curve is in contango. This reflects a volatility risk premium, longer-dated volatility tends to be priced above near-term.

In stressed markets, the curve can invert (backwardate), meaning spot/short-term VIX is higher than longer-term, signaling acute short-term fear (as happened in crises of 2008, 2011, 2018).

The term structure affects traders’ returns: for example, a contangoed curve causes long-Vol ETF rolls to lose value over time. In sum, the VIX level reflects not only current sentiment but also how volatility is expected to evolve across future dates.

VIX Price Performance

Over the past five years, the VIX has been on a rollercoaster, with sharp price swings. It spiked to unprecedented levels during the COVID-19 crash. In mid-March 2020, it jumped into the 80s (peaking just above 85) as equities plunged. As markets rebounded on stimulus and reopening hopes, the VIX fell sharply, averaging below 30 by the summer of 2020.

With economic recovery underway and central banks assuring support, volatility remained subdued. The VIX mostly traded in the mid-to-high teens all through the following year, briefly edging above 25 only on short-lived COVID or inflation scares. However, the VIX climbed into the 20s and briefly into the mid-30s as equities sold off in mid-2022. This level of volatility was significant by recent standards but far below the early-2020 extremes.

Besides a brief jump above 30 when the Silicon Valley Bank crisis rattled markets in March 2023, the VIX trended lower. By year-end 2023, it was roughly 40–45% below its 2022 levels.

The VIX stayed relatively calm for much of 2024, typically in the mid-teens to low 20s. The notable exception was early August 2024, when a sudden unwind of a yen-carry-trade strategy sent the VIX shooting to an intraday high near 65. This spike quickly reversed – within about a week, the VIX had plunged back to the mid-teens (around 16).

In early April 2025, following aggressive U.S. tariff announcements, the VIX surged to 52.33 (its highest closing level in five years). As markets stabilized on the view that trade tensions may be contained, the VIX retreated. By early June, it was hovering around 17½ (roughly its long-term median). For example, on June 9, the VIX fell to about 16.8 after better-than-expected U.S. jobs data and progress on U.S.–China trade talks. As of mid-June 2025, the VIX remains in the high teens (around 17), well below crisis levels but above the recent lows of ~12 seen a year earlier.

Looking ahead to the rest of 2025, analysts expect volatility to remain elevated around key events, especially the US/China trade war, the ongoing conflicts in Ukraine/Russia, and in the Middle East. Several firms have raised year-end equity targets (reflecting optimistic gains) but also warn of repeated volatility spikes on policy and geopolitical news. In short, if trade disputes and economic uncertainty simmer, VIX spikes are likely; if those risks ease, volatility should subside toward its historical norm (roughly the mid-teens to low-20s).

How to Trade the VIX

While the VIX Index itself is not directly tradable, several financial instruments are linked to its fluctuations. These include:

Let’s explore these instruments in detail to understand how they can be used in VIX trading.

VIX CFDs

The easiest method to trade the VIX is via CFDs. Contracts for Difference (CFDs) on the VIX allow traders to speculate on market volatility without owning the underlying asset. These instruments provide flexibility and leverage, sometimes as high as 1:200 on brokers like Switch Markets, which can amplify potential returns as well as risks. The CBOE VIX, acting as a ‘fear gauge’, significantly influences the price movements of VIX CFDs, since the latter perform as a derivative product for the CBOE VIX.

However, you should be aware that trading VIX CFDs comes with its own set of challenges. These instruments do not have a fixed expiration date but are subject to daily CFD rollovers, which can impact trading strategy. Additionally, the high degree of leverage involved means that a substantial percentage of retail investor accounts experience losses.

Therefore, traders must approach VIX CFDs with caution and a well-thought-out risk management plan. For those who are keen to start trading the VIX index, Switch Markets offers the VIX index in the form of CFDs, with a leverage ratio and access to advanced trading platforms.

VIX Futures Contracts

VIX futures contracts offer another way to trade future volatility levels based on the VIX Index. Introduced in 2004, these contracts enable traders to speculate on anticipated market volatility and manage risk in their investment portfolios through a futures contract. The final settlement value for VIX futures is determined through a Special Opening Quotation (SOQ) on the expiration date, providing a standardized mechanism for contract settlement.

For those interested in short-term trading, VIX Weekly futures, introduced in 2015, offer more frequent expiration dates, typically listed weekly. These contracts add flexibility and opportunities for traders to respond to market volatility on a shorter time horizon.

Whether for hedging or speculation, VIX futures contracts are a valuable tool for engaging with market volatility.

VIX Options

VIX options, launched in 2006, provide another avenue for trading market volatility. Unlike traditional options, the pricing of VIX options is closely tied to the expected future prices of VIX futures contracts rather than the current index level.

This unique characteristic makes VIX options a powerful tool for traders looking to capitalize on anticipated changes in market volatility. Vix works effectively to provide insights into these fluctuations.

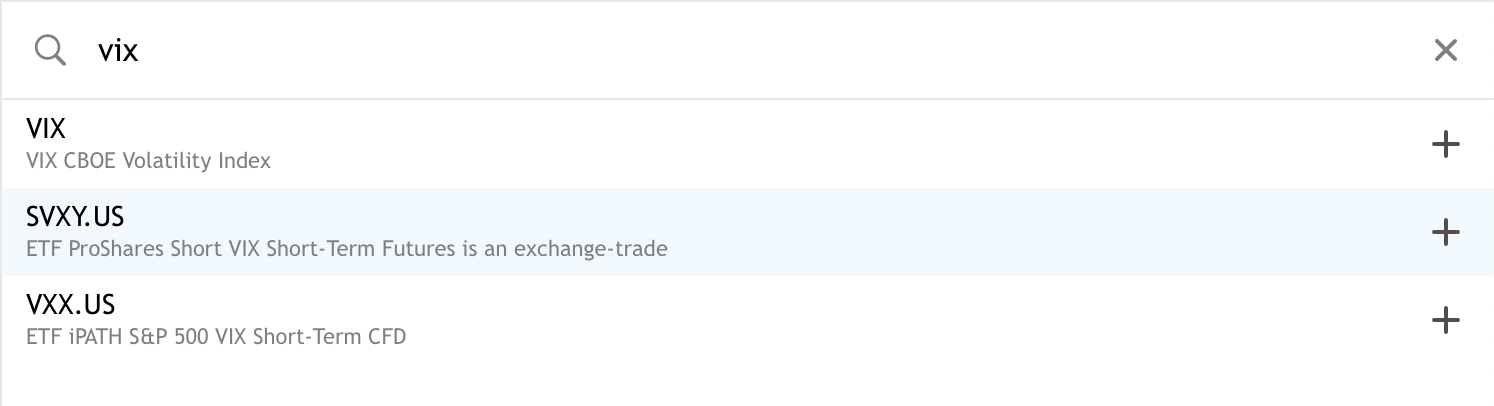

VIX ETFs and ETNs

Exchange-traded funds (ETFs) and exchange-traded notes (ETNs) linked to the VIX offer a more accessible way for investors to trade market volatility. Key points include:

- These products track VIX futures rather than the index itself, providing exposure to future volatility.

- One of the most prominent ETNs is the iPath Series B S&P 500 VIX Short-Term Futures ETN (VXX), which is available on Switch Markets' platform.

- VXX allows investors to gain exposure to VIX-related investments and exchange-traded products. VIX ETFs exist to further enhance these investment opportunities.

- Switch Markets also offers ProShares Short VIX Short-Term Futures ETF (SVXY), another popular option to trade the VIX index.

Selecting the right VIX ETF or ETN is crucial based on market expectations and trading strategy. These instruments provide a convenient way for investors to engage with market volatility, whether for hedging or speculative purposes.

Summary

In sum, trading the VIX offers a unique way to engage with market volatility, providing opportunities for both hedging and speculation. For day and swing traders, the VIX can be an ideal speculation asset, especially when the markets are in crash mode and there’s panic.

There are various ways to trade the VIX index, including CFDs, options, futures, and ETFs. If you are looking for VIX trading via CFDs, then Switch Markets is the place to start. At Switch Markets, you get the ability to trade VIX with a leverage ratio of up to 1:200 on MetaTrader 4/5. Additionally, Switch Markets' users get a variety of free tools, including a free VPS, a tracking application to track and analyze performance, and Algo Builder, an AI tool that enables you to automate your trading strategies without coding.

FAQs

Here are some common questions regarding the VIX index:

Why is the VIX Index called the 'Fear Index'?

The VIX Index, or 'Fear Index,' quantifies expected market volatility derived from S&P 500 options prices, reflecting investor sentiment and risk. It typically rises when stock prices decline, signaling heightened fear and uncertainty in the market.

How can you buy the VIX index?

There are several options to buy the VIX index - through options, futures, ETFs, and CFDs. Each option provides unique avenues for capitalizing on market volatility, with CFDs being the simplest method to purchase the VIX index.

How can you buy the VIX index ETF?

To buy a VIX index ETF, you need a brokerage firm that enables you to buy VIX ETFs. Switch Markets, for instance, offers two of the most traded VIX ETFs, the Barclays iPath Series B S&P 500 VIX Short-Term Futures ETN Series B (VXX) and the ProShares Short VIX Short-Term Futures ETF (SVXY).

How to read the VIX index?

The VIX index measures expected market volatility—a high VIX means fear and potential market drops, while a low VIX suggests stability and investor confidence. Typically, when the VIX rises above 30, it can imply that there is high risk in the markets, while a value below 20 suggests that the markets are in a stable condition.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.